Airport modernization and fiscal savings from NAIA privatization

This Saturday, Sept. 14, the New NAIA Infra Corp. (NNIC) will take over the upgrading, modernization, operation, and maintenance of the Ninoy Aquino International Airport (NAIA). The members of NNIC are San Miguel Holdings Corp., RMM Asian Logistics, Inc., RLW Aviation Development, Inc., and the Incheon International Airport Corp. The estimated project cost (as of […]

This Saturday, Sept. 14, the New NAIA Infra Corp. (NNIC) will take over the upgrading, modernization, operation, and maintenance of the Ninoy Aquino International Airport (NAIA). The members of NNIC are San Miguel Holdings Corp., RMM Asian Logistics, Inc., RLW Aviation Development, Inc., and the Incheon International Airport Corp.

The estimated project cost (as of approval) is P170.6 billion. The main goals of this privatization scheme are to increase airport capacity from 35 million passengers per annum (mppa) to 62 mppa; to increase air traffic movements (ATMs) from 40-42 per hour to 48 ATMs per hour; to deliver internationally benchmarked Minimum Performance Standards and Specifications (MPSS); and to improve passengers and airlines experience and retail options. In the process, it should help improve the Philippines’ attractiveness as a tourism, investment, and trade destination.

The concession period is 15 years, from 2024 to 2039, extendable for another 10 years so long as the NNIC is able to fulfill its obligations or at least not be in flagrant violation of the Concession Agreement on the 8th anniversary of the signing date.

This is a beautiful scheme. On the government side, lots of work was done by the Department of Transportation (DoTr) which focused on infrastructure and regulatory aspects. But equally important work was contributed by the Public-Private Partnership (PPP) Center, headed by Executive Director Cynthia C. Hernandez.

They facilitated and complemented the work of DoTr, plus ensured the delivery of internationally benchmarked MPSS. They facilitated and monitored the implementation of the signed concession agreement between the parties, helped mobilize private sector resources and expertise for the modernization and capacity expansion of NAIA, spearheaded the project’s feasibility and financial structuring (such as defining the terms of concession periods, revenue sharing, and financial models) and coordinated the project through various stages — including the submission to the Investment Coordination Committee, obtaining National Economic and Development Authority (NEDA) Board approval, overseeing the competitive bidding process, and interacting with reviewing bodies such as the Office of the Government Corporate Counsel and the Office of the Solicitor General.

The economic team — NEDA as mother agency of the PPP Center, and Finance and Budget departments — also contributed via policy guidance, fiscal incentives, and related policies.

The PPP Center shepherded the DoTr and MIAA through the PPP process, especially with recent policy changes, so that the processes were in line with the then Build Operate Transfer (BOT) Law and its Implementing Rules and Regulations (IRR). Since the procurement process commenced in August 2023, the bidding rules followed were in accordance with the BOT Law and the Revised 2022 IRR. Note that the NAIA PPP Project’s Concession Agreement already implements the new PPP Code as its governing law.

I was wondering if this scheme is unique in the Philippines. The PPP Center clarified that the modality of NNIC is consistent with many other international airports that operate under similar PPP models. Examples include the London Heathrow Airport and Sydney Airport where private companies took on airport operation, management, modernization and maintenance responsibilities, sharing revenues with the government.

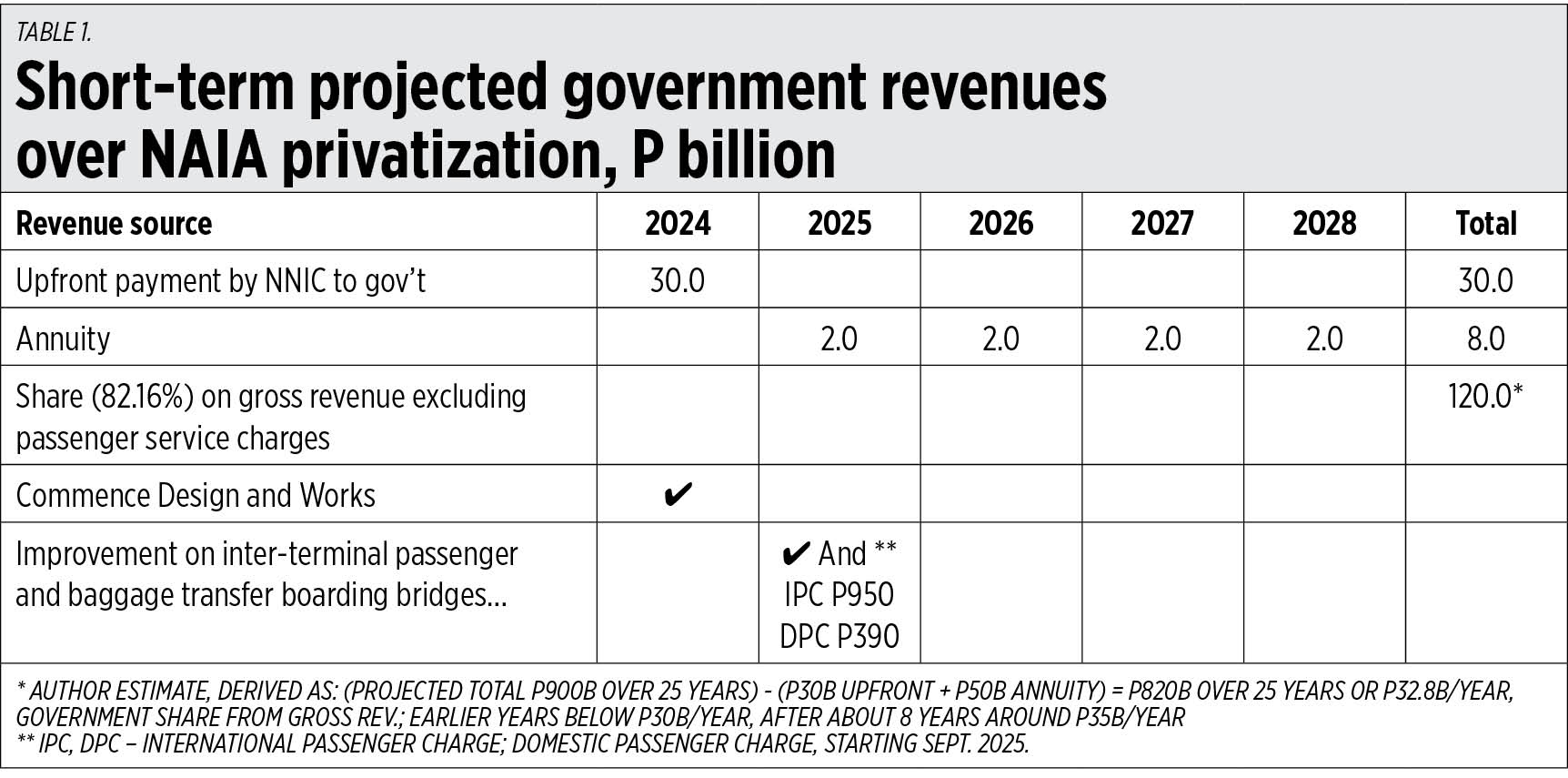

The government’s share from this scheme is substantial, starting with an upfront P30-billion payment to the government, a P2 billion annual guaranteed payment, and a share from gross revenues (see Table 1).

I am interested in public finance, and how taxpayers and even non-users of the airport can benefit via the unburdening from more borrowings. I computed the savings by the government both in principal and interest payments, from 2024 to 2028. My estimate is that there will be P158 billion in savings from the principal (as this amount will not be borrowed), plus P9.8 billion from foregone interest payments because we will not borrow this amount (see Table 2).

Congratulations, DoTr, PPP Center, NEDA, Department of Finance and Department of Budget and Management. Thank you, SMC and other members of the NNIC.

As there is more modernization of the Philippines, there will be more growth and job creation, and sustained high growth. Little by little, project by project, we should stay on track in this direction.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.