Tax compliance creates safeguards in a digital economy

A survey conducted by Capstone-Intel from Nov. 22 to 29, 2023, involving 1,503 respondents across the country, revealed that nine out of 10 Filipinos are currently using finance applications for their daily transactions, with only 2% of the respondents claiming that they are not using any finance applications. Capstone-Intel Research and Publications stated that local […]

A survey conducted by Capstone-Intel from Nov. 22 to 29, 2023, involving 1,503 respondents across the country, revealed that nine out of 10 Filipinos are currently using finance applications for their daily transactions, with only 2% of the respondents claiming that they are not using any finance applications. Capstone-Intel Research and Publications stated that local sari-sari (sundry) stores have digital financing options for their customers, implying the need for the National Government to enhance the measures to safeguard the consumers to further ensure the safety of Filipinos.

In another report prepared by the National Strategy for Financial Inclusion 2022-2028 (NSFI) of the Bangko Sentral ng Pilipinas (BSP), it was indicated that as of 2019, 11.5% of internet/mobile phone users used digital financial services (DFS). NSFI predicts that around 50% of internet/mobile phone users will be using DFS by 2028.

Meanwhile, on Aug. 15, the Department of Finance, as recommended by the Commissioner of Internal Revenue, issued Revenue Regulations No. 15-2024 (RR 15-2024), prescribing guidelines on the mandatory registration of persons engaged in online trade or business, among others. RR 15-2024 imposes the following guidelines for registration, among others, as follows:

a.) A person engaged in the sale and/or lease of goods and services through Brick-and-Mortar Stores shall register its head office at the BIR (Bureau of Internal Revenue) district office having jurisdiction over the place of business address. Meanwhile, any branch and/or facility shall be registered with the BIR district office having jurisdiction over the place of business address or location of the branch and/or facility.

b.) A person operating, maintaining or setting up an online presence (within the context of these Regulations) or an online store for its Brick-and-Mortar Store shall register its Store Name with the BIR as an additional “business name” attached to the head office or branch managing or operating the said online store or business, and shall not be registered as branch.

c.) A person engaged in the sale and/or lease of goods and services through website, webpage, page, platform, or application who does not have a Brick-and-Mortar Store shall register at the BIR district office having jurisdiction over the place of residence for individuals or principal place of business registered with the Securities and Exchange Commission (SEC) for juridical entities.

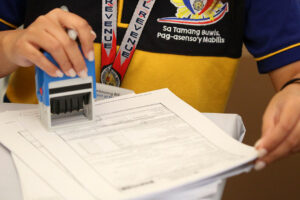

RR 15-2024 also requires the posting of the Certificate of Registration (COR)/ Electronic Certificate of Registration (eCOR) at the place where the business is conducted and at each branch and/or facility in a way that is clearly and easily visible to the public. And for those who do not have a fixed place of business, the COR/eCOR shall be kept in the possession of the holder or at the place of residence or at the head office’s address, if applicable, subject to production upon demand of any internal revenue officer.

In the case of persons/entities that are operating through a website, social media, or any digital or electronic means, they shall conspicuously display their electronic copy of the COR/eCOR on their website, webpage, account, page, platform, or application.

Failure to abide by these regulations may lead to the closure of the business operations through the issuance of a Closure/Take Down Order, which shall not be less than five days, and shall only be lifted upon compliance with RR 15-2024.

RR 15-2024 also imposes the responsibility on the lessors, sub-lessors of commercial establishments/buildings/space, and operators of digital platforms, including e-marketplace platforms to ensure that all their respective lessees and online sellers or merchants are duly registered with the BIR, have a Taxpayer Identification Number, and are duly compliant with the invoicing requirements in accordance with Sections 236, 237 and 238 of the Tax Code.

While tax compliance is the primary objective of these Regulations, the effect includes strengthening the safeguards to consumers transacting in a digital economy. Consumers may reasonably check the identity of the online seller/merchant/business by examining the COR/eCOR required to be posted clearly and visibly to the public.

The views and opinions expressed in this article are those of the author. This article is for general information and educational purposes, and is not offered as, and does not constitute, legal advice or legal opinion.

Mary Joy Ann B. Dela Cruz is an associate of the Tax department of the Angara Abello Concepcion Regala Cruz Law Offices.